What is supplemental insurance?

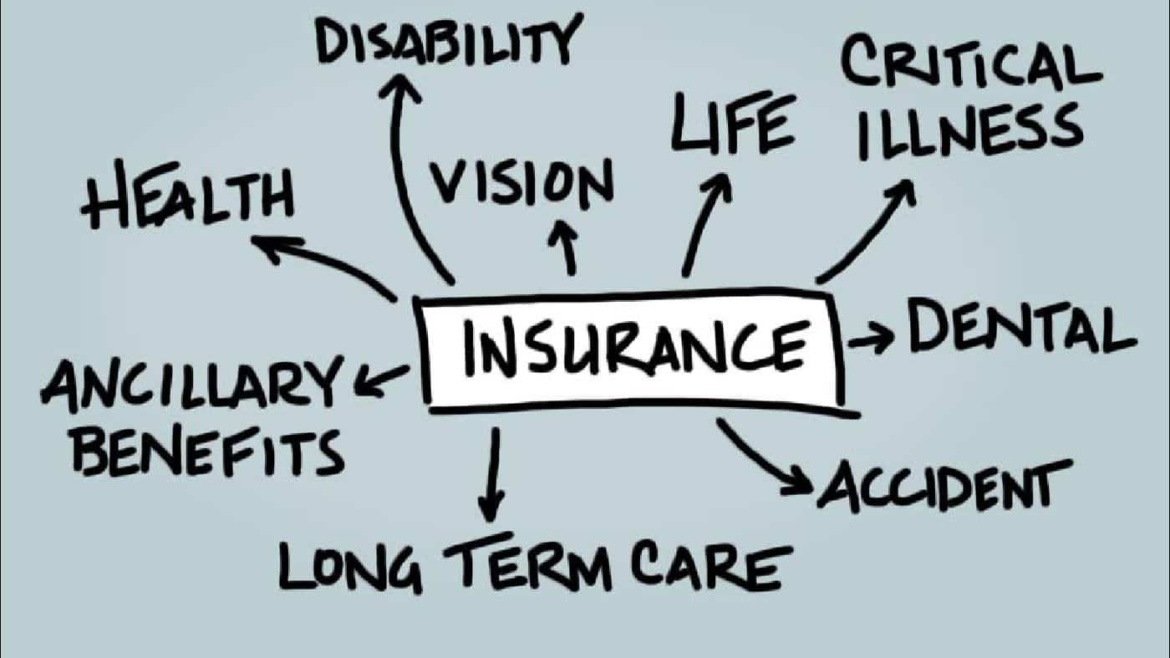

Supplemental insurance refers to an insurance policy that supplements your primary health insurance coverage. Supplemental insurance includes a variety of policies that can be offered by employers or purchased on their own, including:

- Short-term disability

- Long-term disability

- Dental/ Vision insurance

- Accident /Sickness insurance

- Critical illness insurance

- Medicare Supplemental Insurance, otherwise known as Medigap coverage.

- some consider this Medigap plans an add-on optional insurance coverage that pay some or all of the out-of-pocket costs for treatment that’s covered under Original Medicare, including coinsurance and deductibles.

Supplemental insurance is extra or additional insurance that you can purchase to help you pay for services and out-of-pocket expenses that your regular insurance doesn’t cover.

Some supplemental insurance plans will pay for the out-of-pocket cost-sharing that goes along with your health insurance plan (deductibles, copayments, and coinsurance), or for medical services that your health plan doesn’t cover at all, such as dental and vision costs.

Other supplemental plans may provide you with a cash benefit paid out over a period of time or given to you in one lump sum. The cash can be used for:

- Covering lost wages

- Transportation related to your health condition

- Food, medication, and other unexpected expenses you have due to an illness or injury

Do I Need Supplemental Health Insurance?

Whether you need this type of health plan depends on your risk factors. You should also think about the cost of the premiums, how much insurance you want to carry, and what you want to be insured for. You may decide that a dental plan is worth buying if you think that your children will need it to cover orthodontic care in the coming years.

You might think about a supplemental plan if you know that you couldn’t afford the costs of long-term care, or the loss of income if you were diagnosed with something like cancer. Long-term care or critical illness plans may be worth thinking about in these cases.

Your savings should play a key role in your decision to purchase a supplemental health plan. Would you have enough money to cover your deductible, copays, and coinsurance if you were in the hospital for a few weeks or even more? Do you have money that you can access because you’ve been saving to an HSA or FSA? Buying a supplemental health plan might not be worth it if you do.